|

Posted By Vinny Bivona - Chair of Municipal Liaison Committee,

Monday, May 19, 2025

|

The NYC Lien Sale has been extended to June 3, 2025

- The lien sale removal deadline has been extended two weeks.

- The last day to take action to remove your property from the sale is June 2, 2025.

- The lien sale will be held on June 3, 2025.

For more information on the NYC Lien Sale, please visit NYC Property Tax Lien Sale

Tags:

Lien sale

NYC

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Wednesday, May 14, 2025

|

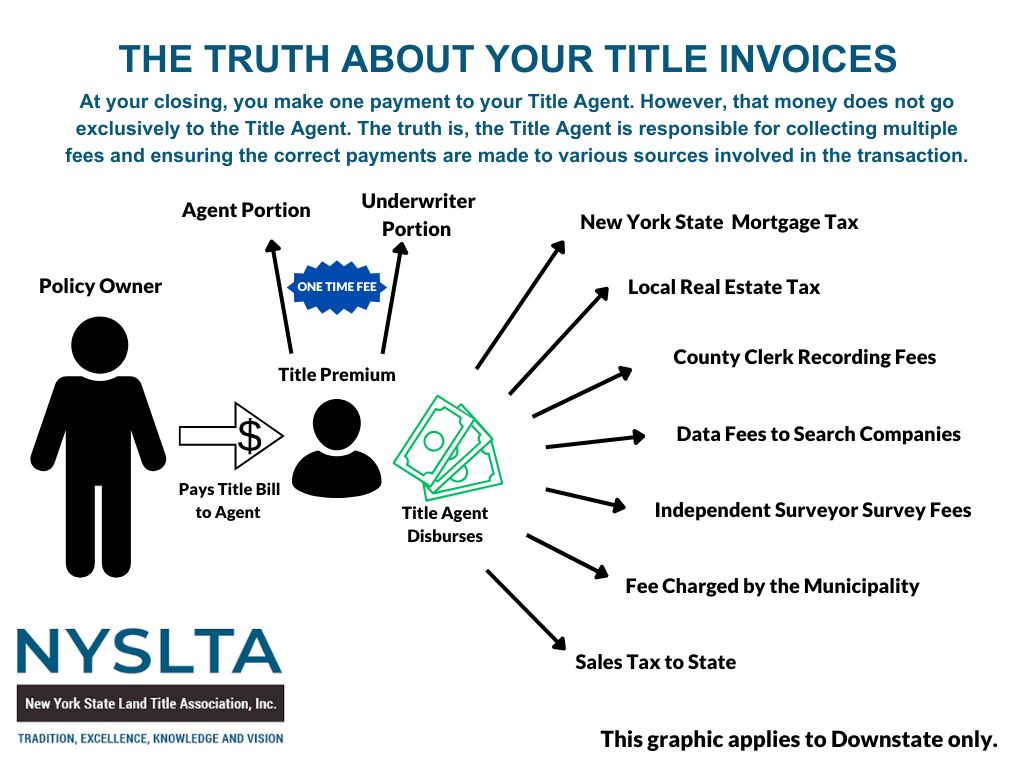

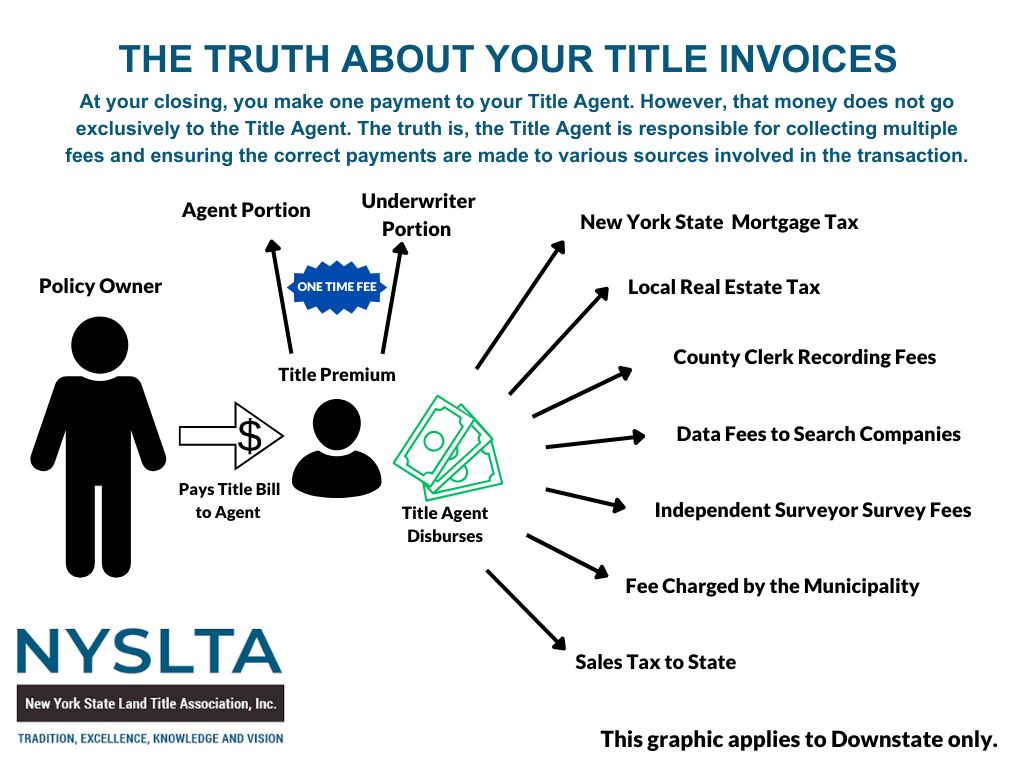

On May 13, 2025, the Executive Committee approved the distribution of the following infographic. This infographic may be used to respond to questions about the title bill.

You can download a JPG by clicking the button below.

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Wednesday, April 30, 2025

|

What Is a “Notice of Recorded Document”?

This is a notification sent to registered subscribers each time a deed, deed-related document, mortgage, or mortgagerelated document has been recorded against a specific property in New York City. You must register to receive notification. Property owners and their agents (including child, spouse, or domestic partner of owner if they are a designee),

the managing agent, the property owner’s attorney, the lienor, or executors/administrators of the estate of the owner or

leinor of the property should register to be notified of documents recorded against the property. Notification will usually

be issued the day after a document is recorded. Note: The Department of Finance is required to record all documents

that meet recording requirements.

Why Should I Register to Receive Notification?

Receiving a “Notice of Recorded Document” will alert registered property owners when documents are recorded without their knowledge and will allow them to take steps to limit the harm caused by the recording of a fraudulent document. How Do I Register?

Registering is easy and fast. Register electronically by visiting the Department of Finance website, www.nyc.gov/finance, or the ACRIS website, www.nyc.gov/acris and click on the “Recorded Document Notification” link. You can register by using your property address or the borough block and lot number. You may also submit a completed "Notice by Mail of Recorded Document" application which is available on our website or by calling 311. Can I Register to Receive Notification for More Than One Property at a Time?

No. You must register separately for each property.

Are There Any Fees Involved When Registering?

There are no fees to register or to receive a notification sent via e-mail or regular mail. However, text message rates

may apply (please consult with your carrier).

How Long Will My Registration Last?

Your registration will remain in effect until you opt out of receiving notification.

What Should I Do if I No Longer Wish to Receive Information About a Particular Property?

You must “delete” your registration information by visiting the New York City Department of Finance website

www.nyc.gov/finance or ACRIS website www.nyc.gov/acris and click on the “Recorded Document Notification” link. You may also delete your registration by submitting a completed “Notice by Mail of Recorded Document” application which is available on our website or is available by calling 311.

Will I Receive Notification for Every Document Recorded on the Property?

No, a “Notice of Recorded Document” will be sent only when the following documents have been recorded:

Department of Finance

Deed and Deed-Related Documents

Agreement

Air Rights

Condemnation Proceedings

Condo Declaration

Confirmatory Deed

Contract of Sale

Correction Deed

Court Order

Deed

In Rem Deed

Judgment

Life Estate Deed

Memorandum of Contract

Power of Attorney

Real Estate Investment Trust Deed

Revocation of Power of Attorney

Sundry Agreement

Unit Assignment

Mortgage and Mortgage Related Documents

Agreement

Collateral Mortgage

Correction Mortgage

Court Order

Initial UCC1 (financing statement)

Judgment

Mortgage

Mortgage and Consolidation

Mortgage Spreader Agreement

Satisfaction of Mortgage

Subordination of Mortgage

Sundry Mortgage

Should an Owner (or the designee) of an Individual Cooperative Apartment Unit or Timeshare Register?

It is not recommended that an owner (or designee) register because individual cooperative apartments units or timeshares do not have a unique block and lot number. If an owner (or designee) of a cooperative apartment unit or Timeshare registers to receive notification, registration can only be for the entire building. The registrant will receive a Notice of Recorded Documents affecting the building rather than a particular apartment unit or timeshare. This may result in a large number of unnecessary notifications.

What Should I Do if I Receive a “Notice of Recorded Document” and the Property is in Manhattan (New York

County), The Bronx, Brooklyn (Kings County), or Queens?

You should:

1. Go to the website at www.nyc.gov/acris and click on “Search Property Records”.

2. Enter the borough, block and lot number of the property and then you can review the document for which you have

received a “Notice of Recorded Document.” (If you do not have access to a computer you may visit one of our City

Register locations listed below.)

3. If you own property with another party/parties, you may want to contact them to find out if the other party/parties

is/are aware of the document for which you have received notice.

What Should I Do When I Receive a “Notice of Recorded Document” and the Property is in Staten Island

(Richmond County)?

If the property is in Staten Island, you must visit the Office of the Richmond County Clerk to view a copy of the

recorded document.

What will happen after I register for notification?

Immediately after registering, you will receive an automatically generated email confirming that you elected to receive

email notices whenever documents are recorded against the entered BBL. If you do not receive this email within 15 minutes, please verify that you entered the correct email address. If the email address that you entered (per the confirmation screen) is incorrect, you should re-register to receive notice using the correct email address. If you had used the correct email address, please check your junk mail as the antispam and email filtering you may be running can potentially cause these emails to arrive in your junk email folder. To prevent future emails from doing the same, please add acrisnrd@finance.nyc.gov to your safe senders list. If the email address that you entered is correct and the email is not in your junk email folder, you should call 311.

If you requested registration of notification for a BBL, then starting the day of the registration you will be notified via email

when any deed, deed-related document, mortgage, or mortgage-related document is recorded against that BBL. The

email will contain a reference to the document(s) recorded the previous day.

If you register by submitting a completed "Notice by Mail of Recorded Document" application, you will receive a confirmation

of your registration by mail and receive notices by mail whenever documents are recorded against the entered

BBL. If you do not receive the confirmation within two weeks, you should call 311.

What will happen after I request deletion of my registration?

Immediately after requesting deletion of your registration you will receive an automatically generated email confirming

that you elected to no longer receive email notices whenever documents are recorded against the entered BBL. If you

do not receive this email within 15 minutes, please verify that you entered the correct email address. If the email address that you entered (per the confirmation screen) is incorrect, you should re-register to receive notice using the correct email address. If you had used the correct email address, please check your junk mail as the antispam and email filtering you may be running can potentially cause these emails to arrive in your junk email folder. If you request deletion of an existing registration for a BBL and any deed, deed-related document, mortgage, or mortgage-related document is recorded against that BBL the day you requested deletion, you will receive an email notification; however, you will not receive notification of any subsequent recordings unless you register again.

If you request deletion of your registration by submitting a completed "Notice by Mail of Recorded Document" application, you will receive a confirmation by mail that you elected to no longer receive notices whenever documents are recorded against the entered BBL. If you do not receive the confirmation within two weeks, you should call 311.

After I Review the Document, What Should I Do?

1. If you know about the recorded document and it is correct you do not need to take any further steps.

2. If the document is incorrect or if you were not aware of the document, call 311. If you are calling from outside of

New York City, call 212-NEW-YORK or 212-639-9675. The call center representative will be able to refer you to an

appropriate agency to assist you in resolving your issue.

Department of Finance l Division of Land Records l City Register Locations

MANHATTAN BRONX

66 John Street, 13th Floor 3030 Third Avenue, Room 280

New York, NY 10038 Bronx, NY 10455

BROOKLYN QUEENS

210 Joralemon Street, Room 2 144-06 94th Avenue

Brooklyn, NY 11201 Jamaica, NY 11435

OFFICE OF THE RICHMOND COUNTY CLERK

130 Stuyvesant Place

Staten Island, N.Y. 10301 Disclaimer

The Department of Finance assumes no liability for failure to provide the requested notice of

recorded document with respect to the property for which you are registering to receive notification.

The City of New York, including the Department of Finance, and the Office of the Richmond

County Clerk assumes no liability for performing its legal duty to record documents, even if those

documents are in some instances later be determined to be erroneous, fraudulent, or invalid.

Tags:

NY City Register

NYC Department of Finance

Permalink

| Comments (0)

|

|

Posted By Bill Collins,

Tuesday, April 22, 2025

|

A lot of times we think about DEI as only about race or gender, but

neurodivergency is also a factor in hiring. Title insurance jobs tend to be

non-customer-facing, and call for attention to detail and focus that

neuro-divergent workers often excel at. As

more and more of our older employees retire, many of our companies are

looking for the best possible people as the next generation of title

insurance professionals, especially searchers and readers. The unique

requirements for those jobs- careful attention to detail, intense focus,

and recognition of slight differences- are often qualities held by

those suffering from Autism Spectrum Disorder (ASD). However the job

interview process often shortchanges those individuals, as social

awkwardness masks their abilities. The following article explains how

recognizing those interview biases can reward your company with great

employees. https://theconversation.com/why-people-with-autism-struggle-to-get-hired-and-how-businesses-can-help-by-changing-how-they-look-at-job-interviews-254658

Tags:

Career employment

DEI

employers

hiring

Jobs

Permalink

| Comments (1)

|

|

Posted By Robert Treuber,

Friday, April 4, 2025

|

Superintendent Harris’s Operations and Technology Transformation Hits

Major Milestones with DFS Connect Launch and 1000 Hires and Promotions

Since January 2022 The New York State Department of Financial Services

(DFS) today launched the DFS Connect platform, marking a significant

milestone in the Department’s ongoing operations and technology

transformation. Under Superintendent Adrienne Harris’s leadership, over

the past three years, DFS has executed a strategic plan to invest in

human capital, modernize technological resources, and streamline

processes. These efforts ensure that DFS remains a forward-thinking,

responsive regulator in an evolving financial landscape. “Over the

last three years, we have cultivated a culture of innovation, invested

in new technological infrastructure, and updated key processes,” said Superintendent Harris. “DFS

Connect is a pivotal example of how we are innovating to enhance

regulatory oversight while making it easier for New Yorkers and

businesses to engage directly with the agency,” Over the course of

the next three years, the DFS Connect digital portal will centralize

the Department’s interactions with regulated entities and consumers. DFS

Connect is eliminating outdated, fragmented systems and replacing them

with a single, streamlined platform that enhances efficiency, improves

oversight, and ensures better service to businesses and consumers. With

today’s launch, New Yorkers can now submit complaints about

prescription drug costs, pharmacy benefit managers (PBMs), and drug

manufacturers. Once a complaint is submitted, an individual can track

its status in real-time and communicate directly with DFS staff about

their issue. By 2027, all consumer complaints and regulatory functions

agency-wide, such as licensing, renewals, examinations, financial

statements and legal filings, will be handled seamlessly through DFS

Connect. Since 2022, DFS has prioritized modernizing its

regulatory infrastructure to ensure it is well-equipped to manage

emerging risks. This has included a comprehensive technology overhaul,

the establishment of the agency’s first Data Governance Office, and the

hiring of the Department’s first-ever Chief Technology Officer and Chief

Risk Officer. These steps have allowed DFS to enhance its analytical

capabilities, implement real-time risk monitoring, and improve

decision-making processes. DFS has also invested heavily in

strengthening its workforce, hiring and promoting more than 1,000

individuals over the past three years, including the first class of

financial services examiner trainees since 2018. Additionally, the

Department has expanded its regulatory capabilities by establishing the

Climate Division and the Pharmacy Benefit Unit and elevating key

operational functions by creating an executive leadership role dedicated

to internal operations. These staffing investments, combined with

business process redesign efforts, have eliminated backlogs that had

persisted for years. Since implementing a new regulatory tracking system

in 2023, DFS has now cleared more than 30,000 backlogged regulatory

filings, ensuring more efficient oversight of financial institutions. The

Department will continue to invest in cutting-edge technology,

data-driven oversight, and a highly skilled workforce to maintain its

status as a 21st-century regulator. By enhancing its efficiency and

responsiveness, DFS is not only adapting to the complexities of the

modern financial landscape but also strengthening protections for New

Yorkers and the financial system at large. For more information or to sign up for DFS Connect, visit the DFS website or the DFS Connect platform.

Tags:

consumer

DFS

portal

Regulations

Permalink

| Comments (0)

|

|

Posted By Bill Collins,

Thursday, March 20, 2025

|

IQS will be taking over Monroe County’s Land Records starting 4/1/2025. There will be eventually be a paywall to view said records. To aid with the transition, no instruments will be put on record on 3/28, or accepted electronically, though instruments will be accepted and time stamped if presented personally at the MCCO desk. No receipts for the instruments will be given at the counter that day.

Tags:

County Clerks

IQS

Monroe County

recording

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Monday, March 10, 2025

|

EXECUTIVE COMMITTEE MEETING

New York State Land Title Association

First American Title Insurance

666 Third Ave, NY.NY

March 11, 225

10:30 AM

AGENDA

1. Call to order – President Canino

2. Roll call - Executive Director Treuber

3. President’s Greeting – President Canino

4. Approval of February Minutes - Executive Director Treuber

5. Exec Director Report – Executive Director Treuber

6. Treasurer’s Report – Ms. Schwartzman

7. Title Section Report – Chair Alonso

8. Agent Section Report – Chair Giliotti

a. Municipal Charges

b. Infographics

c. Reg. 208

d. Yonkers

e. PAC- Expanding

9. Advocacy Committee Report – Chair Pereyo & Chair Stancanelli

10. Education Committee – Chair Carrillo

11. Career Development Committee – Chair Vozza

12. Legislative Committee Report – Chair Pro Tem Spinner

13. Municipal Liaison Committee Report – Chair Bivona

14. Charitable Works Committee – Chair Roper

15. New Business

16. Adjourn

The twelve voting members of the Agents and Abstracters Section will be:

Richard Giliotti

John Burke

Sarah Labar

Bill Collins

Phil O’Hara

Linda Lynch

Andrew Zankel

DeAnna Stancanelli

Sal Turano

Mark D’Addona

The next Executive Committee Meeting will be held at 10:30 am on April 8, 2025 via ZOOM.

Tags:

Executive Committee

Permalink

| Comments (0)

|

|

Posted By Vinny Bivona - Chair of Municipal Liaison Committee,

Wednesday, January 29, 2025

|

Please note the NYC HPD Online website has been experiencing display issues affecting the system’s ability to display open work orders with dollar amounts that have been completed by HPD but not yet transferred to DOF for collection. The municipal liaison committee is aware of this issue and is communicating with HPD as they work towards a solution. There have been multiple maintenances to the site recently with hopes that each maintenance would correct the issue. Last night’s maintenance was the latest performed maintenance still without resolve. The individual service companies are carefully reviewing the HPD records and those searches that are accurate are being sent timely. Those that are shown to have issues are being held or completed with a disclaimer until HPD corrects the problem. We will continue to monitor and stay in communication with HPD until this is resolved.

Tags:

NY DOF

NY HPB

NYC

Permalink

| Comments (0)

|

|

Posted By Vinny Bivona - Chair, Municipal Liaison Committee,

Tuesday, January 28, 2025

|

Effective February 1, 2025, the Town of Cortlandt in Westchester County will increase their Municipal Title Search Fees to $150 per search fee plus $20 per copy.

See attached Town of Cortlandt Master Fee List.

A chart of municipal search fees is posted to the County & Municipal File Library in the Member Resources Section . You must be signed in to your member account to access the Resource Section.

You can download the current chart from the first link below. Logged-in members can find an updated chart of all available municipal fees in the 2nd link below

Attached Files:

Tags:

fee chart

Municipal Liaison

Town of Cortlandt

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Monday, January 27, 2025

|

A2739 |

NYS Assembly Member Cruz introduced a bill, A2739, this week.

The bill, if it becomes law, will regulate the

business practices of mortgage pay-off servicers and mortgagees as it

pertains to payment acceptance.

This measure originated with the NYSLTA. We met with

Assembly Member Cruz to present the problem of pay-off servicers

destroying bank checks, blocking our ability to contact the services for

remedy and other problems for title companies and their clients.

The result of such practices created interest

windfalls for lenders, the risk of foreclosure by sellers and

purchasers, and delays in remedying a payoff due to improper lender

notification.

Our Greenberg-Traurig consultants and the Advocacy Committee drafted sample language that is presented in this bill.

Conversations are being held to find a Senate sponsor to introduce a "same-as" bill in the State Senate..

|

|

If payment is received at the location and in the manner specified by the mortgagee:

- The pay-off servicer / the mortgagee must accept and may not return or destroy any payment received in reliance on a payoff statement;

- The pay-off servicer / the mortgagee must promptly apply such payment to the unpaid principal, interest or any other amounts due under the mortgage.

Failure to comply results in fines to the mortgagee.

| |

- Title companies would now have the force of law and the remedy

of escalating fines to correct pay-off servicer business practices.

- This bill is a milestone for NYSLTA, as it is the first time we have proposed a legislative cure for a title industry problem.

- By first strategically presenting this issue to the DFS Banking

Division and Insurance Division and gaining their understanding of the

problem, we are positioned to have the regulator's acknowledgement for

the need to cure when queried by the legislative staff.

.

- The NYSLTA furthers its credentials as a consumer advocate.

| |

|

After several title agents reported problems with

pay-off services, the NYSLTA began outreach in 2019 and succeeded in

arranging meetings with senior executives at SPS. Although solutions and

changes in their business practices were discussed and promised, the

change never came about.

We continued to seek corrections with

payoff-servicers. We had a series of email and ZOOM communications with

the Mr. Cooper company. Small improvements were accomplished but the

problems persisted industry-wide.

In 2023, the NYSLTA Advocacy Committee met with the

DFS Banking Division to alert them to these issues. In 2024, our DFS

Consultant at Greenberg-Traurig addressed the problems with pay-off

servicers and other title insurance issues with the DFS Insurance

Division.

Late in 2024, the NYSLTA discussed this issue with

Assembly Member Catalina Cruz, who expressed interest in helping us.

Working with our lobbyists at Greenberg-Traurig, the Advocacy Committee

outlined a legislative measure which Assembly Member Cruz and her staff

turned into the bill attached to this email.

| |

- We will work with a member of the Senate to introduce a senate version of the bill.

- Make sure your TAN membership is current. Go HERE to check or sign-up.

- Respond to TAN alerts. It is the easiest way for you to tell your representatives WHY this bill is important.

- Read NYSLTA email for updates and check the Newsblog on the NYSLTA website.

Tags:

Catalina Cruz

mortgage pay-off

mortgage servicers

mortgagee

NYS Assembly

Permalink

| Comments (0)

|

|