|

Posted By Bill Collins, Frontier Abstract - Co-Chair, Back To Work Committe,

Monday, August 10, 2020

Updated: Monday, August 10, 2020

|

While some of our members continue to have most of their employees work remotely, many members have returned to partial or full staffing since the pandemic started.

As the pandemic continues, members keep a close eye out for outbreaks that may happen in their offices. More and more research is showing that indoor air environment may play a much more important role in the spread of the novel coronavirus than surface transmission.

This article by a professor of engineering who specializes in indoor air quality has some valuable advice for avoiding spread in your office when employee’s test results come back positive.

https://theconversation.com/how-to-use-ventilation-and-air-filtration-to-prevent-the-spread-of-coronavirus-indoors-143732

Click the attached file for the most recent Back-To-Work FAQ.

Attached Files:

Tags:

Back-To-Work

Coronavirus

COVID-19

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Tuesday, June 23, 2020

Updated: Thursday, July 30, 2020

|

NYSLTA BACK TO WORK COMMITTEE

Questions to consider when creating a BTW Plan UPDATED JULY 28, 2020

The Executive Committee of the NYS Land Title Association formed a special task force in May 2020 to prepare guidance for member companies in anticipation of the eventual lifting of restrictions and the return to the traditional workplace.

The Back-To-Work Group has compiled a multi-page PDF document covering a dozen topics such as liability, good practices, reporting requirements, human resources concerns, office cleaning and disinfecting, PPE, health & wellness, social distancing, business

travel and risk assessment.

Logged in members can access the BTW Guide here.

The file is also available by navigating to: SECTIONS> ABSTRACTERS & AGENTS SECTION and selecting the file named "Back-To-Work FAQ 7-28-2020" PDF (232.43 KB) from the file library on that page.

Tags:

Back-To-Work

BTW

change management

Coronavirus

COVID-19

WFH

Work from Home

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Wednesday, April 22, 2020

Updated: Wednesday, April 22, 2020

|

The Technology Committee has compiled a guide to tools and technologies for title professionals who are working from home.

You can view/download it HERE or from the WFH Handbook link on this page.

You can also locate the Handbook in the Technology Committee File Library, following the top navigation path:

RESOURCES > DOCUMENTS & FILE LIBRARIES > TECHNOLOGY COMMITTEE FILE LIBRARY

If you have suggestions for the next edition of the Handbook, please email RGT@NYSLTA.ORG

Attached Files:

Tags:

COVID-19

technology

WFH

Work from Home

Permalink

| Comments (1)

|

|

Posted By Robert Treuber,

Wednesday, April 22, 2020

Updated: Wednesday, April 22, 2020

|

NYSLTA Land Records Committee has received the following information from the Office of the Suffolk County Clerk.

LAND RECORDINGS CONTINUE IN SUFFOLK COUNTY

Due to the COVID19 outbreak and out of an abundance of caution, the Suffolk County Clerk’s Office has closed its building operations to the public. The health and safety of our employees and constituents is of utmost concern. By executive order, our on-site staff has been severely reduced with the majority of employees working remotely.

Business continuity has been achieved as we are able to process documents remotely with minimal processing impact.

As a recording office, we know our job is essential to the economy and we are very much aware that the land title and mortgage banking industries rely heavily on documentation obtained from our office and the timely processing of same.

Title Examiners

The SCCO has provided a NO COST 24/7 remote access portal for viewing all records that are currently in the system which dates back to 1987 for land records and 2004 for judgements, liens, lis pendens and uniform commercial codes. Automated requests for documents beyond these dates will also be accommodated through the same remote access portal. Those that wish to download images have that capability as well with a new convenient feature that accepts credit cards. Help Desk resources are also available to account users.

Communications

The status of our office operations is available on the Clerk’s website www.suffolkcountyny.gov/clerk.

Here is a quick view:

· Closed to the public, but processing

o E-Recording (Simplifile, CSC, EPN)

o Mail (we strongly recommend FED EX, UPS, USPS express)

o Drop-offs in the Lobby (subject to change)

· Documents being processed

o Paper recordings

o E-Recordings (Simplifile, CSC, EPN)

o E-Recordings – Most documents accepted

o Documents will be processed in date-received order for all incoming submissions (E-recording, mail and drop-offs)

· Website

o www.suffolkcountyny.gov/clerk

o Recording questions recording@suffolkcountyclerk.com

o E-Recording questions erecording@suffolkcountyclerk.com

o Map questions maps@suffolkcountyny.gov

o Judgement questions judgements@suffolkcountyny.gov

· Searching

o Index (1987)

o Grantor/grantee books on line (1893 forward)

o Document images (1987 mortgages /deeds)

o Document images (2004 liens/judgments/UCC/LP)

o *Document images (1973 to 1984 deeds)

o *Real Property Tax Maps (1976 images)

o *Sub-division Filed Maps (1952 west end towns/all east end)

o Building Loan Agreements (1984 index/2004 images)

o Mechanics Liens (1984 index/2004 images)

o Print options (available remotely thru kiosk)

o *Certified copy requests (available remotely thru kiosk)

o *Hard copy request program (available remotely thru kiosk)

*New enhancements

· Acceptance of Remote On-Line Notarization (RON)

o Yes. We will accept RON provided that the notary acknowledgment language includes it to be in full compliance within the requirements set forth in Gov. Executive Order 202.7

· Anticipated return to regular business operations

o Unknown

· Outreach

o Website updates www.suffolkcountyny.gov/clerk

o Automated VOIP system 631-852-2001 x800

o Social media (County Clerk Pascale FB page)

o NYSLTA, PRIA, E-Recording providers

Office of the Suffolk County Clerk

Judith A. Pascale

www.suffolkcountyny.gov/clerk

631-852-2001 x800

Tags:

County Clerk

COVID-19

Land Records

Suffolk

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Thursday, April 16, 2020

Updated: Thursday, April 16, 2020

|

The following bulletin has been issued by the Office of the Nassau County Clerk. Please read in its entirety, as certain part concern examining and recording land records.

https://nassaucountyny.gov/agencies/Clerk/index.html

You can download the bulletin from the link on this page.

In an effort to protect our staff and the residents we serve, the Nassau County Clerk’s Office is closed for in person access. We continue to operate with very limited staff in accordance with the Governor’s orders. Documents are processed in the order they are received. Please use the following procedures to utilize the services of our office.

**While New York State has delayed the opening of the SCAR filing period, petition forms are still available on the County Clerk’s website to print and prepare at home. Please do not send SCAR filings to the County Clerk’s office until the courts have resumed full operations and a SCAR filing period has been announced.**

Land Records

• Document recordings can be submitted through e-recording, mail/delivery or lobby drop box

• Online records are available at:

https://i2f.uslandrecords.com/NY/Nassau/D/Default.aspx

• Document requests can be mailed/delivered or placed in lobby drop box

Court Records

• Per the Courts Administrative Order only matters deemed essential are being accepted. The Order can be found at: https://www.nycourts.gov/whatsnew/pdf/AO-78-2020.pdf

• SCAR proceedings are not considered essential by the courts and therefore SCAR applications will not be accepted until further notice

• Document filings only pertaining to essential matters can be submitted through NYSCEF e-filing, mail/delivery or lobby drop box

• Online records are available at: https://iapps.courts.state.ny.us/nyscef/HomePage

• Document requests can be mailed/delivered or placed in lobby drop box

For information on Court proceedings please visit

http://ww2.nycourts.gov/COURTS/10JD/nassau/index.shtml

Documents virtually notarized are being accepted during the Governor’s designated period. Inclusion of a certification page attesting to this is encouraged.

Passport Services are suspended. Please visit

https://travel.state.gov/content/travel/en/passports.html for additional information.

All other County Clerk services will be provided where deemed essential.

To set up a pre-paid account for in-office services please visit our website and click the Set up Pre-Paid Account link in the tab section to the left.

Document submissions or requests must include the appropriate payment or pre-paid account information and self-addressed stamped envelope for receipt and/or document return to:

Nassau County Clerk

240 Old Country Road

Mineola, NY 11501

For emergencies only, please contact:

countyclerk@nassaucountyny.gov

Attached Files:

Tags:

County Clerk

COVID-19

Land Records

Long Island

Nassau County

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Tuesday, April 14, 2020

Updated: Tuesday, April 14, 2020

|

Released on April 13, 2020

https://www.dfs.ny.gov/industry_guidance/industry_letters/il20200413_covid19_cybersecurity_awareness

Re: Guidance to Department of Financial Services (“DFS”) Regulated Entities Regarding Cybersecurity Awareness During COVID-19 Pandemic

To: All New York State Regulated Entities

As we face an unprecedented threat from the novel coronavirus known as “COVID-19,” every organization’s highest priority must be health and safety. The extraordinary steps necessary to combat the COVID-19 pandemic have also created new challenges as regulated entities work to continue operating and providing critical services. Among these new risks is a significant increase in cybercrime, as criminals seek to exploit the situation.[1]

The Department of Financial Services (“DFS”) has identified several areas of heightened cybersecurity risk as a result of this crisis. As called for by DFS’s cybersecurity regulation, 23 NYCRR Part 500, regulated entities should assess the risks described below and address them appropriately.[2]

We also remind all regulated entities that, under 23 NYCRR Section 500.17(a), covered Cybersecurity Events must be reported to DFS as promptly as possible and within 72 hours at the latest. Prompt reporting will enable DFS to respond quickly to new threats as DFS works to protect consumers and the financial services industry in these difficult times.

Heightened Risks

- Remote Working

The abrupt shift to mass remote working forced by COVID-19 has created new security challenges, and attackers are exploiting these new vulnerabilities.[3] These heightened risks to regulated entities’ networks and Nonpublic Information[4] include:

- Secure Connections. Companies should make remote access as secure as possible under the circumstances. This includes the use of Multi-Factor Authentication and secure VPN connections that will encrypt all data in transit. See 23 NYCRR §§ 500.12 & 500.15.

- Company-Issued Devices. As new devices such as computers and phones are acquired or repurposed for remote working, regulated entities should ensure that they are properly secured. This includes locking down the devices so applications cannot be added or deleted by the user, and installing appropriate security software, such as Endpoint Detection & Response and Mobile Device Management.

- Bring Your Own Device (BYOD) Expansion. Regulated entities that have expanded their BYOD policies to enable mass remote working should be aware of the security risks and consider mitigating steps. Some personal devices are not properly secured or are already compromised. If an expanded BYOD policy is necessary, compensating controls should therefore be considered.

- Remote Working Communications. Remote working has increased reliance on video and audio-conferencing applications, but these tools are increasingly targeted by cybercriminals. Regulated entities should configure these tools to limit unauthorized access, and make sure that employees are given guidance on how to use them securely.

- Data Loss Prevention. Employees may be using unauthorized personal accounts and applications, such as email accounts, to remain productive while remote working. Regulated entities should remind employees not to send Nonpublic Information to personal email accounts and devices. Anticipating and solving productivity problems will reduce the temptation to use such devices.

- Increased Phishing and Fraud

There has been a significant increase in online fraud and phishing attempts related to COVID-19. For example, the FBI has reported that criminals are using fake emails that pretend to be from the Centers for Disease Control and Prevention (“CDC”), ask for charitable contributions, or offer COVID-19 relief such as government checks.[5]

-

Regulated entities should remind their employees to be alert for phishing and fraud emails, and revisit phishing training and testing at the earliest practical opportunity. Now that face-to-face work is curtailed, authentication protocols may need to be updated – especially for key actions, like security exceptions and wire transfers.

- Third-Party Risk

The challenges created by the COVID-19 pandemic have also affected third-party vendors, and regulated entities should re-evaluate the risks to critical vendors. See 23 NYCRR § 500.11. Regulated entities should coordinate with critical vendors to determine how they are adequately addressing the new risks.

Conclusion

The COVID-19 pandemic has disrupted normal operations in the financial services industry and beyond, and cyber criminals are exploiting the crisis. Despite the extraordinary challenges, regulated entities should remain vigilant. By following good cybersecurity practices, entities can identify, mitigate, and manage the risks.

[1] See DHS Cybersecurity and Infrastructure Security Agency (“CISA”), COVID-19 Exploited by Malicious Cyber Actors (April 8, 2020).

[2] Heightened cyber risk should also be addressed in the COVID-19 operational preparedness plans called for by DFS guidance issued on March 10, 2020. See Guidance to New York State Regulated Institutions and Request for Assurance of Operational Preparedness Relating to the Outbreak of the Novel Coronavirus.

[3] See FBI, Cyber Actors Take Advantage of COVID-19 Pandemic to Exploit Increased Use of Virtual Environments (April 1, 2020); U.S. Secret Service, Secret Service Issues COVID-19 (Coronavirus) Phishing Alert (March 9, 2020).

[4] 23 NYCRR § 500.01(g).

[5] See FBI, FBI Sees Rise In Fraud Schemes Related to the Coronavirus (COVID-19) Pandemic (March 20, 2020).

Tags:

Coronavirus

COVID-19

cybersecurity

DFS

technology

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Saturday, April 4, 2020

Updated: Saturday, April 4, 2020

|

https://www.dfs.ny.gov/industry_guidance/industry_letters/il20200403_paycheck_protection_loan_program

Industry Letter

April 3, 2020

To: The Chief Executive Officers or the Equivalents of New York State Regulated Institutions

The New York State Department of Financial Services (Department) is issuing this letter with respect to the Paycheck Protection Loan Program (the Program) created by the recently enacted Coronavirus Aid, Relief and Economic Security Act (CARES Act), through which the U.S. Small Business Administration’s (SBA’s) 7(a) Loan Program [1] will offer a new loan product. The CARES Act provides for forgiveness of up to the full principal amount of qualifying loans guaranteed under the Program.

As you know, the COVID-19 pandemic has placed many small businesses, not-for-profit organizations and their employees in dire need of funding to survive. The Program is intended to provide economic relief to small businesses nationwide, including the many New York businesses that have been significantly adversely impacted by the COVID-19 pandemic.

Yesterday, the SBA issued its interim final rule, announcing the implementation of the CARES Act for the Program. The interim final rule includes formal guidance that outlines the key elements of the SBA’s implementation of the Act, and the SBA requests public comments.

The interim final rule provides that a lending institution does not need to conduct any verification if the borrower submits documentation supporting its request for a loan and attests that it has accurately verified the payments for eligible costs. The SBA Administrator will hold harmless any lender that relies on such borrower documents and attestations. The loans guaranteed under the Program will be under the same terms, conditions and processes as other 7(a) loans with certain exceptions, such as the guarantee percentage being 100%, and the lack of a requirement for collateral or personal guarantees.

The Program authorizes existing 7(a) lenders to participate in the Program, and allows for the authorization of additional 7(a) lenders if the lender is (1) a federally insured depository institution or a federally insured credit union; (2) any Farm Credit system institution with certain exceptions; and (3) certain specified types of depository and non-depository financing providers that originate, maintain and service business loans or other commercial financial receivables and participation interests, subject to meeting certain additional criteria.

Small business lending is at the core of what many of your institutions do every day. Your knowledge of the local markets and community needs, along with your underwriting skills, are exceptionally important during this time of crisis. Your active participation is critical to the success of this Program and the much needed help our small businesses deserve during this unprecedented interruption to their operations and the lives of many of their employees.

The Department strongly encourages all its institutions that are eligible to participate in the Program to participate and provide this desperately needed help to small businesses so they can weather the current crisis and sustain their employee base, subject to their safety and soundness requirements. The Department also encourages those that are not currently eligible for participation to obtain eligibility so they can participate in the Program.

The Department appreciates all of your hard work to keep the financial system open and operating in New York State and commends you for your leadership and support of small businesses during the current crisis.

Sincerely,

Linda A. Lacewell, Superintendent

New York State Department of Financial Services

1 The 7(a) Loan Program is the SBA’s primary program for providing financial assistance to small businesses.

Tags:

COVID-19

DFS

Lacewell

SBA

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Saturday, April 4, 2020

|

Guidance to Insurance Producers regarding Electronic Delivery of Notices

Guidance to Insurance Producers regarding Electronic Delivery of Notices Pursuant to new 11 NYCRR § 229.5(b) and 3 NYCRR § 405.6(b)(4)

The Department of Financial Services (“Department”) is aware of insurance producers (“Producers”) facing challenges complying with the notice obligations in new 11 NYCRR § 229.5(b) and 3 NYCRR § 405.6(b)(4) described below (“Notice Obligations”).

First, regarding obtaining consumers’ consent to electronic communications, please see the Department’s Current Guidance Regarding Electronic Signatures, Transactions, and Filings with DFS.

Second, the Department is accommodating Producers by reducing their burden to fulfill the Notice Obligations during the current state of emergency. Specifically, for the duration of the current state of emergency, Producers may comply with the Notice Obligations by emailing the notices to the consumers for which the Producers have email addresses, regardless of whether the consumers have consented to receiving this notice via email.

Producers with websites should post the information on their websites as soon as possible. The Department also encourages supplemental dissemination of the content of the Notice Obligations by other means, including social media.

Finally, Producers should maintain records of their communications with consumers, electronic or otherwise, used to satisfy the Notice Obligations for a period of time sufficient to satisfy applicable statutes of limitation and, where an action or claim is pending, for such period of time until the matter is resolved. See Office of General Counsel Opinion 05-03-32 (March 24, 2005). In addition, if a Producer obligated itself by contract with its principal, the insurer or insured, to retain records for a period of time, then such obligation, if legally enforceable, must be satisfied, subject to an alternative acceptable to the principal. These communications used to satisfy the Notice Obligations may be subject to Department review, including but not limited to, on examination.

Below is a summary of the insurance producer requirement in the relevant emergency regulations.

New 11 NYCRR § 229.5(b) and 3 NYCRR § 405.6(b)(4) require a licensed insurance producer who services an in-force life insurance policy, annuity contract, or fraternal benefit society certificate or who procured a property/casualty insurance policy for the policyholder or contract holder to mail or deliver notice to the policyholder or contract holder of the provisions of 11 NYCRR 229 and 3 NYCRR § 405.6 within ten business days following the promulgation of 11 NYCRR 229 and 3 NYCRR § 405.6.

Tags:

Coronavirus

COVID-19

DFS

disclosure

Regulations

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Friday, April 3, 2020

Updated: Thursday, April 9, 2020

|

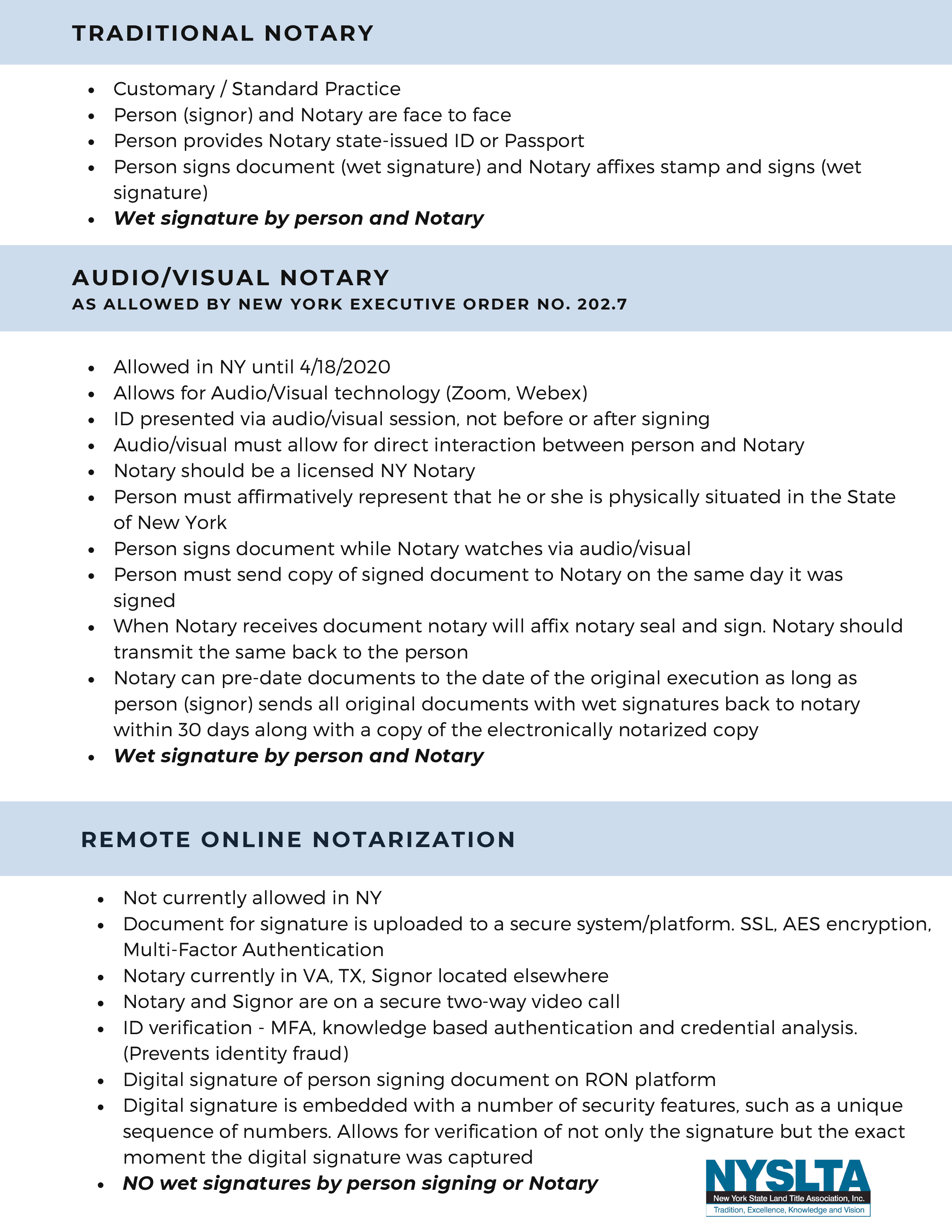

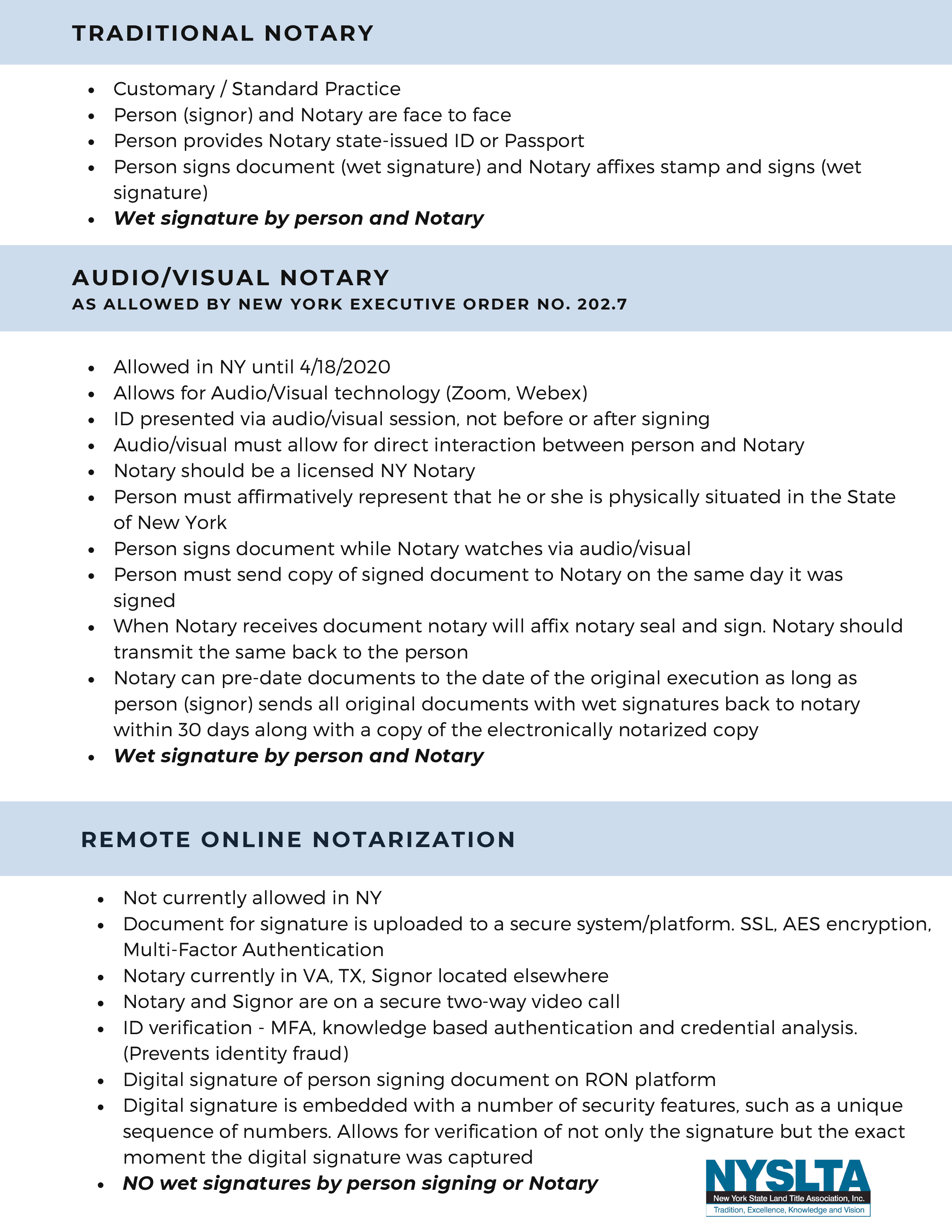

There is confusion about this temporary solution (let's call it A/V Notarization) and the commercially available service called Remote Online Notary (RON).

Here is an easy to understand Explainer. Click the link below to download it.

Attached Files:

Tags:

COVID-19

Executive Order

Notary

RON

Permalink

| Comments (0)

|

|

Posted By Robert Treuber,

Tuesday, March 31, 2020

Updated: Tuesday, March 31, 2020

|

THE FOLLOWING NOTICE HAS BEEN POSTED ON THE WEB PAGE OF

THE SUFFOLK COUNTY CLERK

LAND RECORDINGS CONTINUE IN SUFFOLK COUNTY

Due to the COVID19 outbreak and out of an abundance of caution, the Suffolk County Clerk’s Office has closed its building operations to the public. The health and safety of our employees and constituents is of utmost concern. By executive order, our on-site staff has been severely reduced with the majority of employees now working from home. Business continuity has been achieved as we are able to process documents remotely with minimal processing impact.

As a recording office, we know our job is essential to the economy and we are very much aware that the land title and mortgage banking industries rely heavily on our documentation and the timely processing of same.

Title Examiners. The SCCO has provided a NO COST 24/7 remote access portal for viewing all records that are currently in the system which dates back to 1987 for land records and 2004 for judgements, liens, lis pendens and uniform commercial codes. Automated requests for documents beyond these dates will also be accommodated through the same remote access portal. Those that wish to download images have that capability as well with a new convenient feature that accepts credit cards. Help Desk resources are also available to account users.

Communications. The status of our office operations is available on the Clerk’s website www.suffolkcountyny.gov/clerk. Here is a quick view:

· Closed to the public, but processing

o E-Recording (Simplifile, CSC, EPN)

o Mail (we strongly recommend FED EX, UPS, USPS express)

o Drop-offs in the Lobby (subject to change)

· Documents being processed

o Paper recordings

o E-Recordings (Simplifile, CSC, EPN)

§ Most types of land documents are accepted

o Documents will be processed in date-received order for all incoming submissions (E-recording, mail and drop-offs)

· Website

o www.suffolkcountyny.gov/clerk

o Recording questions recording@suffolkcountyclerk.com

o E-Recording questions erecording@suffolkcountyclerk.com

· Searching

o Index (1987)

o Grantor/grantee books on line (1893 forward)

o Document images (1987 land records/2004 liens, judg, UCC, LP)

o Print options – available

· Acceptance of Remote On-Line Notarization (RON)

o Yes. We will accept RON provided that the notary acknowledgment is modified to include that it was performed in full compliance within the requirements set forth in Gov. Executive Order 202.7

· Anticipated return to regular business operations

o Unknown

· Outreach

o Website updates

o Automated VOIP system 631-852-2000

o Social media (County Clerk Pascale FB page)

o PRIA, NYSLTA, E-Recording providers

Office of the Suffolk County Clerk

Judith A. Pascale

www.suffolkcountyny.gov/clerk

Tags:

Coronavirus

County Clerk

COVID-19

Land Records

Suffolk

Permalink

| Comments (0)

|

|